The Role of Incentives in CEO Compensation

August 28, 2019 7:30 amFrom CUNA’s Credit Union Directors Newsletter

Credit unions use these performance-based awards to attract and retain talent, but they come with risks.

What role do incentives play in CEO compensation?

Incentive pay—which is tied to preset performance criteria—may be a useful tool to attract and retain talent. But research indicates incentives sometimes fail to work as intended, causing demotivation and promoting risk-taking activities that can destroy rather than add value, according to “Incentive Pay: Research and Guidance for Credit Unions,” a research brief from the Filene Research Institute.

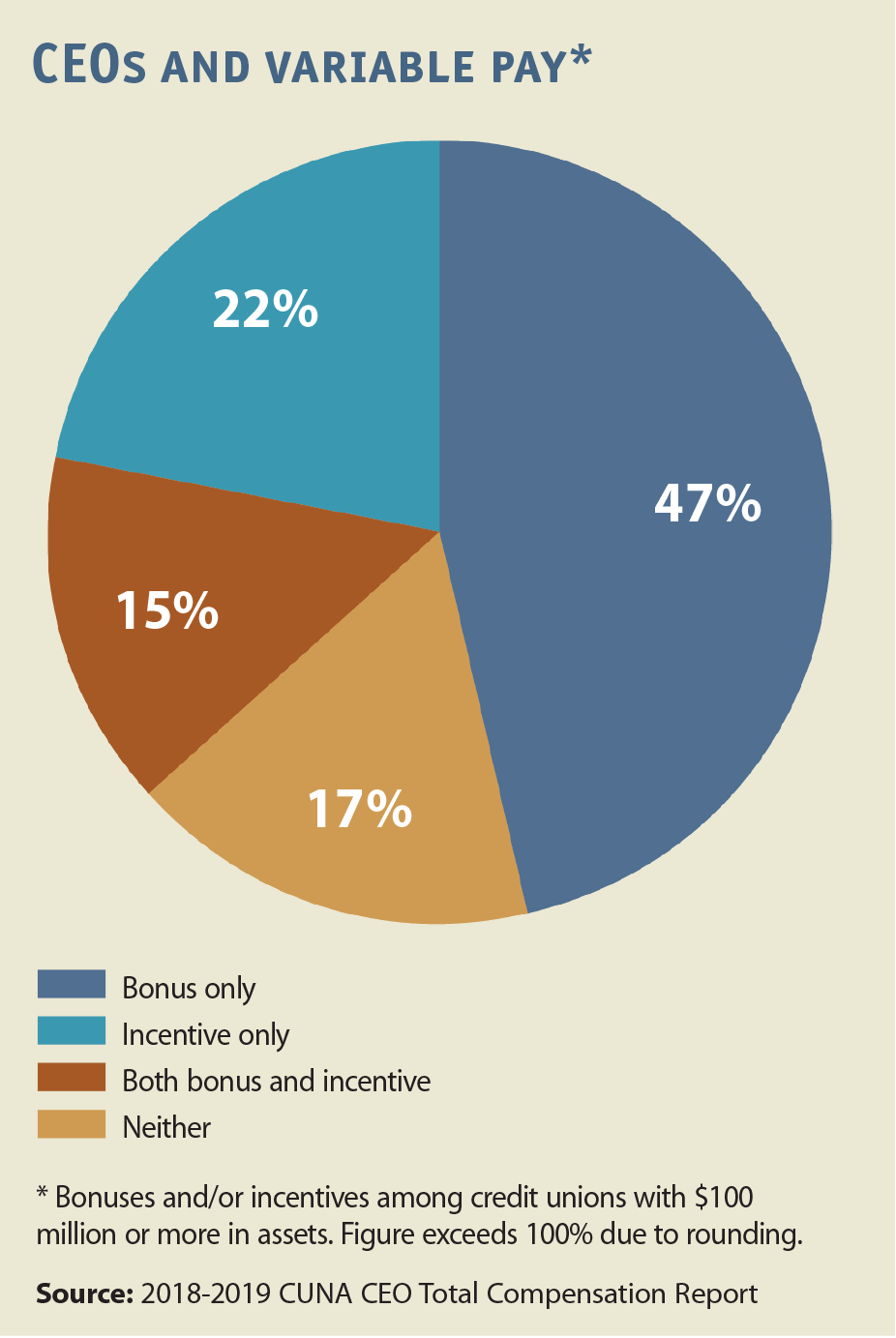

According to the 2018-2019 CUNA CEO Total Compensation Report, 83% of CEOs in credit unions with $100 million or more in assets earned some sort of variable pay—either a bonus or incentives—at year-end 2017. During 2017, bonuses were more prevalent than incentives (62% vs. 37%). The median amount of variable pay was $26,000, although the median level of variable pay increased as asset size increased, according to the CUNA report.

According to the 2018-2019 CUNA CEO Total Compensation Report, 83% of CEOs in credit unions with $100 million or more in assets earned some sort of variable pay—either a bonus or incentives—at year-end 2017. During 2017, bonuses were more prevalent than incentives (62% vs. 37%). The median amount of variable pay was $26,000, although the median level of variable pay increased as asset size increased, according to the CUNA report.

How should you gauge performance?

One risk that accompanies CEO incentive programs is identifying the right metrics to gauge performance.

Two leading criteria credit unions rely on to determine incentive awards for CEOs are loan growth and earnings—including return on assets, return on equity, and return on investments.

Between 60% and 65% of credit unions base CEO incentive pay on these two factors, while roughly half consider membership growth, board evaluations, and net income, according to the CUNA report. However, these measures don’t always accurately reflect sustainable financial performance, management best practices, or cooperative principles, according to the Filene report. Boards must determine when to use more targeted measures and how they benchmark these measures within the organization and across a peer group.

Other factors include the time frame to use for each metric, whether you need subjective or qualitative evaluations, and how to standardize or link those evaluations to objective or quantitative metrics.

What are some best practices when designing incentives?

“Incentives require careful attention to their design and implementation to ensure their effectiveness and prevent unintended consequences,” according to the Filene brief.

Keep these factors in mind when designing an incentive program for the CEO:

- Use incentive pay only when success measures are clearly defined.

- Be transparent about evaluation criteria and explicit about what metrics you’ll use—and when and how you’ll apply them.

- Map the potential risks of specific performance goals.

- Check-in often to track progress, audit reporting, and redirect resources.

This article originally appeared in the August 2019 issue of CUNA’s Credit Union Directors Newsletter and is reprinted (and made available) here with permission (download the .pdf). The monthly newsletter is a great resource that will help your credit union’s board “keep pace with the speed and complexity of change” in our industry. Each issue is well worth the read with timely and relevant topics for your role as credit union board members.

Comments are closed here.